- ChartWiz | Visualized Insights

- Posts

- Earnings Reimagined: SNAP, Spotify, PayPal Through a New Lens

Earnings Reimagined: SNAP, Spotify, PayPal Through a New Lens

Unlock the Potential of Alternative Datasets in Finance

Good Morning,

Welcome to a special edition of ChartWiz, where we’re excited to unveil a new dimension in financial analytics. We’re calling it Alternative Earnings Data but there’s probably a better name for it.

The purpose is to provide exclusive insights that go beyond the traditional income, balance sheet, and cash flow statements.

As a part of our commitment to providing you deeper insights, this edition serves as a prelude to our premium content section, our goal is to provide you with as much value as possible. If you’re interested you can upgrade here.

We hope you love it.

And with that, welcome to ChartWiz!

ALTERNATIVE EARNINGS DATA

Visualizing Spotify's premium revenue versus user growth over several quarters.

Premium MAU (Monthly Active Users) grew from 71 million to 236 million, marking a 232% increase.

Free MAU increased from 86 million to 366 million, which is a 326% increase.

Premium Revenue escalated from 1 billion to 3.2 billion dollars, showing a 211% increase.

Spotify's journey from 2017 to 2023 reflects a masterclass in growth and market penetration. The platform's premium tier, once a choice for a modest 71 million users, has swelled to a colossal 236 million, signaling a consumer vote of confidence in its paid offering. Even more striking is the threefold surge in premium revenue, from $1 billion to a hefty $3.2 billion, far outpacing the already remarkable user growth. This financial windfall suggests not only a growing subscriber base but potentially a successful strategy in upselling services or subtly adjusting subscription rates.

Your AI Supercharged Finance Assistant

SPONSORED

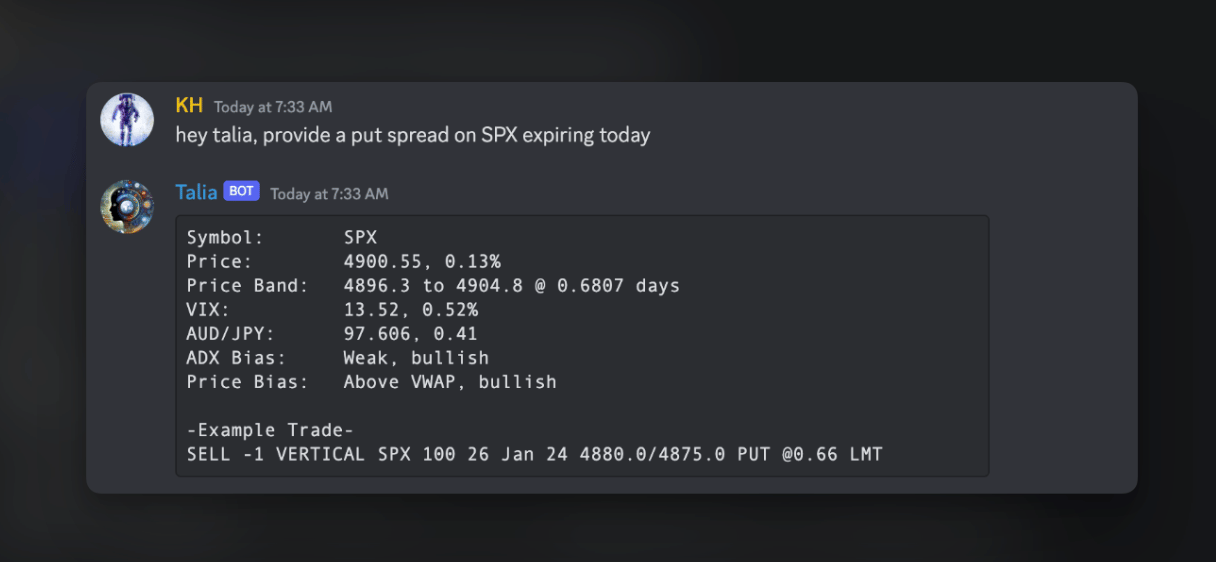

If you’re into stock and options trading, you need this.

Talia is your personal stock options research assistant. Think ChatGPT, but for your own trading. Talia is supercharged with direct access to finance and options data, it does all the research for you.

For a limited time only, our readers can skip the waitlist and get Talia instantly.

ALTERNATIVE EARNINGS DATA

PayPal's ascent in the digital payments arena has been marked by significant milestones, painting a picture of a company that's adeptly navigated the e-commerce boom.

From 2014 to the end of 2023, the statistics narrate a compelling story:

Total Active Accounts rose from 162 million to 428 million, a 164% increase.

Transactions Per Active Account grew from 24.5 to 56.6, a 131% increase.

Despite these impressive numbers, the last eight quarters reveal a plateau in the growth of active accounts, suggesting a new challenge for the company in maintaining its growth trajectory. This leveling trend in user acquisition stands in stark contrast to the earlier exponential growth and may signal a maturation of PayPal's market or increased competition. Yet, the continued increase in transactions per active account showcases that PayPal's existing clientele are transacting more frequently. This dual dynamic of plateauing account growth, alongside robust transactional engagement, offers a unique insight into PayPal's current state and potentially foreshadows a strategic pivot or innovation drive in the near future to spark another round of user growth.

ALTERNATIVE EARNINGS DATA

Snap Inc's performance from 2016 to 2023 paints a vibrant picture of digital engagement that's recently encountered some turbulence.

Delving into the figures:

Snap's Daily Active Users (DAU) catapulted from 158 million to an impressive 414 million, charting a 162% leap.

Ad Revenue per user witnessed a notable ascent from $1.1 to $3.3, accounting for a 213% surge.

Despite this robust expansion, the advertising sector's overall downturn has not spared Snap, with ARPU experiencing a year-over-year decline over the last three years. This general reduction in advertising spend has been a significant factor, contributing to a 35% plummet in Snap's share price after earnings were reported. The correlation between the sector-wide advertising slump and Snap's ARPU downturn underscores the broader challenges faced by ad-driven platforms. As Snap moves forward, its ability to innovate in monetization strategies amidst a fiscally constrained advertising landscape will be crucial in revitalizing investor confidence and stabilizing its financial footing.

CONGRESS INSIGHT

Most Active Traders By Members of Congress

Surprised to not see Nancy? We were too.

Representative Josh Gottheimer led the way with 210 trades over the last six months.

Want to see all of the Congress trades? View them here.

HISTORICAL RETURN

How $10,000 Invested in Spotify (SPOT), PayPal (PYPL), and Snap Inc (SNAP), Would Have Returned Just 2 Years Ago

The investment landscape over the last two years has demonstrated the varied fates of tech stocks SPOT, PYPL, and SNAP, highlighting the unpredictable nature of the market.

Here's a numerical breakdown:

SNAP's value took a downturn, with $10,000 shrinking to $2,958, equating to a 70.42% decline.

PYPL's stake also decreased, now worth $4,899, representing a 51.01% drop.

In stark contrast, SPOT's investment burgeoned to $14,511, a remarkable 45.11% increase.

These figures offer a clear signal to the investment community: sectoral winds can shift rapidly, with some companies harnessing the momentum to their advantage, while others strive to navigate through headwinds.

Most Mentioned Stocks on WallStreetBets

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Additional charts and breakdowns

- • Deeper company insights

- • Bonus alternative market data

- • Chart and research requests

SOCIAL INSIGHT