- ChartWiz | Visualized Insights

- Posts

- Tesla's Not-So Electric Earnings...Netflix Crushed

Tesla's Not-So Electric Earnings...Netflix Crushed

...and WallStreetBets' Trending Tickers

Good Morning,

Welcome to another edition of ChartWiz, where we visualize financial data in bite-sized portions. In today’s edition we break down recent earnings, including Netflix, Tesla, and the stinker at Intel. We also check in with Wall Street Bets…

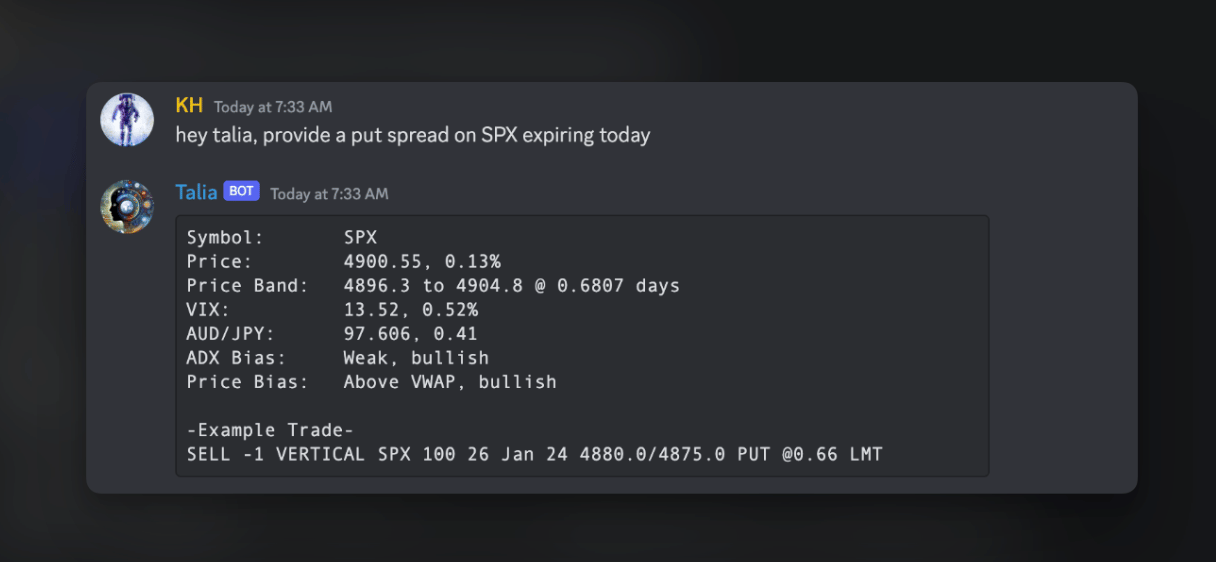

Trade options? You need this, Tiblio just released their new AI trading tool Talia, an incredible options trading assistant — get access today.

And with that, welcome to ChartWiz!

RECENT EARNINGS BREAKDOWN

Netflix’s Earnings Dissected by Region (Q4, 2023)

Key Highlights from their most recent quarter.

Revenue Growth: The company experienced a 12% revenue growth in the year, up from 6% in 2022.

Operating Margin Increase: Operating margin grew to 21% in FY23, exceeding the 20% target and improving from 18% in 2022.

Free Cash Flow: Netflix's free cash flow increased significantly to $6.9B in 2023.

Membership Growth: There was a notable increase in global streaming paid memberships, with Q4 2023 showing the largest ever Q4 net additions.

Ads Business Expansion: The ads business is growing, with plans to make it a substantial revenue stream in the future.

Cash Flow and Capital Structure: There was an increase in net cash provided by operating activities, with a total free cash flow of $6.9B in 2023 and an ongoing content spend plan of up to $17B for 2024.

Your AI Supercharged Options Trading Assistant

SPONSORED

If you’re into investing and options trading, you need this.

Talia is your personal stock options research assistant. Think ChatGPT, but for your own trading. Talia is supercharged with direct access to options data, it does all the research for you.

For a limited time only, our readers can skip the waitlist and get Talia instantly.

HOW DO THEY MAKE MONEY

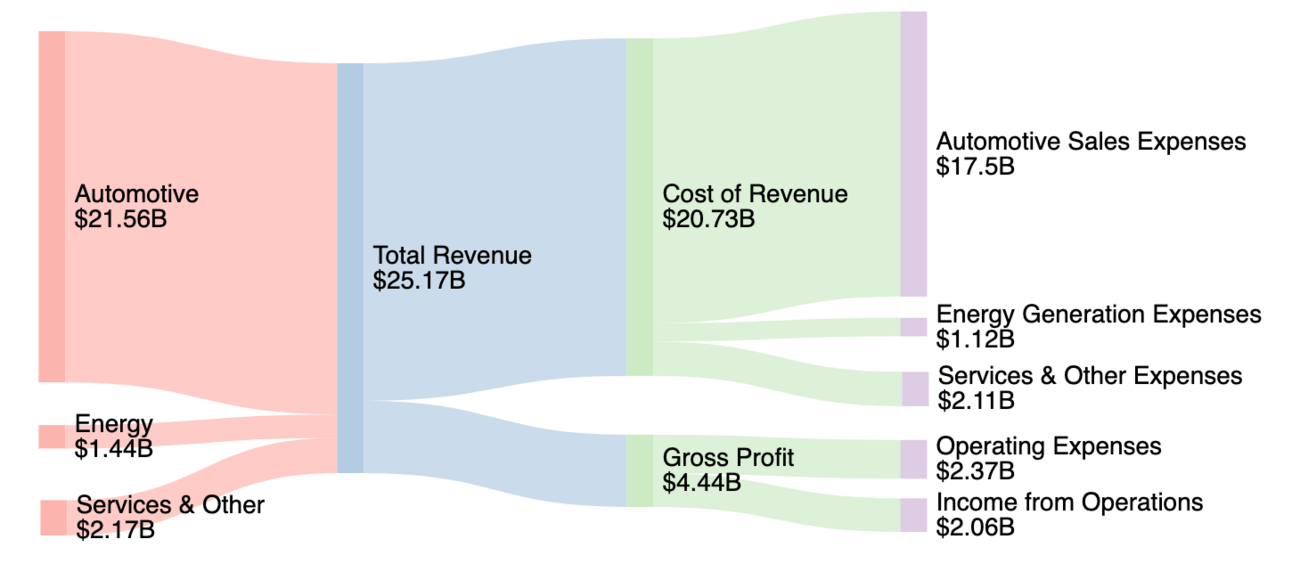

A Breakdown of Tesla’s Earnings & Income Sources (Q4, 2023)

Key Highlights from their most recent quarter.

GAAP Operating Income: $8.9 billion in 2023, a 32.8% increase from $6.7 billion in 2022.

Model Y Sales: Became the best-selling vehicle globally in 2023.

Energy Storage Deployment: 125% growth to 14.7 GWh in 2023.

Cost of Goods Sold per Vehicle: Declined sequentially in Q4 2023.

Energy Storage Deployment: More than double the previous year, reaching 14.7 GWh.

Services & Other Business: Turnaround from ~$500M loss in 2019 to ~$500M profit in 2023.

Model 3/Y Production: Annualized run rate of nearly 2.0 million vehicles in Q4 2023.

COMPANY DEEP DIVE

Full-year revenue was $54.2 billion, a decrease of 14% from $63.1 billion in 2022.

Fourth-quarter revenue was $15.4 billion, up 10% year-over-year (YoY) from $14.0 billion in Q4 2022.

Q4 2023 gross margin was 45.7%, up from 39.2% in Q4 2022.

Q4 operating margin improved significantly to 16.8% from a loss of (8.1)% in Q4 2022.

Geopolitical Tensions and Conflicts: Escalating geopolitical tensions, particularly between the US and China, and global conflicts may affect business operations and market conditions.

Evolving Market for AI Products: The company is navigating an evolving market for products with AI capabilities, necessitating strategic adaptation and innovation. Including an increase in R&D expenditures.

Experience the future of AI marketing with RAD AI, where 3X revenue growth proves its working - over $27M invested, get in on the ground floor today.

83% Subscribed, Invest Before Feb. 16th, Closing Soon.

Disclosure: This is a paid advertisement for RAD AI’s Regulation CF offering. Please read the offering circular at invest.radintel.ai

TSLA (Tesla, Inc.)

The company released Q4 2023 financial results, slightly missing earnings expectations with a reported earnings of $0.71 per share and a 3% revenue increase from the previous year.

Tesla's stock fell by 12% as the company warned that production growth in 2024 might be notably lower than in 2023 due to the focus on launching next-generation vehicles.

NVDA (Nvidia Corporation)

Nvidia's stock jumped 24% based on partnerships with Amgen and Recursion for AI in drug discovery, with the introduction of the BioNeMo platform advancing into beta.

The company teamed up with Equinix to offer AI supercomputers to businesses, with services designed to give companies better control over their data.

Nvidia is focusing on AI-accelerated drug design, predicting that almost everything will start and end in silico in the next decade.

SPY (SPDR S&P 500 ETF Trust)

The S&P 500 and SPY ETF posted gains in four out of five sessions for a three-week win streak.

The ETF has risen 22.95% over the past year, with the street's average price target implying an upside of 8.1%.

WORD FROM WIZ

That’s all we have for you in today’s edition of ChartWiz. If you found this valuable, please consider forwarding it to a friend.

Want to see a chart style or something we don’t have? Reply and let us know!

Have a fantastic week!

-Wiz

How was today's edition?Your feedback helps us make better content |

Reading this but not subscribed?